Investors often compare Palantir Technologies Stocks and Nvidia when evaluating opportunities in the AI sector. Nvidia's reputation as a safer and more diversified investment stems from several factors:

- Its price-to-earnings ratio of 31.17, which is far lower than Palantir's 219.01, highlighting a more cost-effective valuation.

- Its market leadership in GPUs and a broad portfolio of AI products, reducing risks tied to market volatility.

In contrast, Palantir appeals to risk-tolerant investors with its focus on cutting-edge data analytics and AI platforms, offering potentially higher returns.

Key Takeaways

- Nvidia is a safer choice because it leads in GPUs and AI tools.

- Palantir is for bold investors, offering big rewards with its data tools.

- AI is growing fast, and more money will go into it by 2025.

- Nvidia's sales grew 69% in a year, showing strong AI demand.

- Palantir works with governments, which is risky, but its business sales are rising.

- Both companies team up with others to grow and improve in AI.

- Pick Nvidia for safety or Palantir for higher growth, based on your risk level.

- Knowing the market and trends helps you make smart AI investments.

AI Trends in 2025

Growth of AI Across Industries

Key Sectors Driving AI Adoption

AI adoption continues to transform industries in 2025, with several sectors leading the charge. The IT and telecom industry remains a dominant force, leveraging AI for network optimization and cybersecurity. Financial services increasingly rely on AI for fraud detection, risk management, and personalized customer experiences. Manufacturing has embraced AI-driven automation and predictive analytics to enhance efficiency and reduce costs. Across all industries, firms are allocating significant portions of their technology budgets to AI, with 20% of overall tech spending projected to focus on AI solutions.

Projected Market Size for AI Technologies

The AI industry is poised for remarkable growth in 2025. Market studies estimate its valuation will reach USD 294.16 billion, with a compound annual growth rate (CAGR) of 29.2% from 2025 to 2032. By 2032, the market is expected to expand to USD 1,771.62 billion. This rapid growth reflects the increasing demand for AI technologies across sectors, driven by advancements in machine learning, natural language processing, and data analytics platforms like those offered by Palantir Technologies Stocks.

AI’s Role in Stock Market Performance

Impact of AI Innovation on Investor Sentiment

AI innovation has become a key driver of investor sentiment in the stock market. Companies heavily invested in AI technologies have consistently outperformed broader market indices. For example, the 'Magnificent Seven' tech firms saw their stock prices rise by over 100% in the past year, compared to a 24% increase in the S&P 500 index. This disparity highlights the growing importance of AI as a value generator for shareholders. Investors view AI-focused companies like Nvidia and Palantir Technologies Stocks as strategic bets on future growth, further boosting their market appeal.

AI as a Competitive Differentiator for Companies

AI serves as a critical differentiator for companies competing in technology-driven markets. Firms that integrate AI into their operations gain advantages in efficiency, scalability, and innovation. Nvidia’s leadership in AI hardware, including GPUs and chips, positions it as a cornerstone of AI infrastructure. Meanwhile, Palantir’s proprietary AI platforms enable enterprises and governments to derive actionable insights from complex datasets. These capabilities not only enhance operational performance but also attract investor interest, solidifying their competitive edge in the AI sector.

Understanding Palantir Technologies Stocks and Nvidia’s Business Models

Palantir Technologies

Core Business Overview (Data Analytics and AI Platforms)

Palantir Technologies operates as a leader in data analytics and artificial intelligence platforms. Its core offerings, such as Palantir Foundry and Gotham, empower organizations to process and analyze vast datasets, enabling data-driven decision-making. These platforms are designed to integrate seamlessly with existing IT infrastructures, providing actionable insights through advanced machine learning algorithms. Palantir’s focus on enterprise AI solutions has positioned it as a key player in the AI software market.

The company’s business model emphasizes long-term partnerships, particularly in sectors requiring high levels of data security and customization. Palantir’s U.S. commercial revenue grew by 71% year-over-year, reflecting its success in expanding its enterprise customer base. This growth stems from increased IT budgets and a cultural shift toward leveraging AI for strategic decision-making.

Key Customers and Industries Served

Palantir serves a diverse range of industries, including government, healthcare, and financial services. Its Gotham platform is widely used by government agencies for intelligence and defense operations, while Foundry caters to commercial enterprises. Key clients include the U.S. Department of Defense and Fortune 500 companies. These partnerships highlight Palantir’s ability to address complex data challenges across both public and private sectors.

Nvidia Corporation

Core Business Overview (GPUs, AI Hardware/Software)

Nvidia Corporation dominates the AI hardware market, with its GPUs serving as the backbone for AI workloads. The company’s A100 and H100 GPUs are essential for training and deploying machine learning models. Nvidia’s CUDA software further enhances its value proposition by enabling developers to optimize AI applications on its hardware. This combination of cutting-edge hardware and software has solidified Nvidia’s leadership in AI infrastructure.

Nvidia’s business model revolves around innovation and scalability. The company holds an 80% share of the AI accelerator market, driven by its strategic investments in research and development. In Q2 2024, Nvidia reported $26.3 billion in revenue, a 154% year-over-year increase, underscoring its rapid growth in the AI sector.

Key Customers and Industries Served

Nvidia’s customer base spans industries such as technology, automotive, and healthcare. Leading tech firms rely on Nvidia’s GPUs for AI model training, while automakers use its hardware for autonomous vehicle development. The company’s data center segment has also experienced significant growth, with a 112% year-over-year increase in revenue in Q3 FY25. Nvidia’s ability to cater to diverse industries highlights its versatility and market dominance.

Comparison of AI Capabilities

Palantir’s AI Strengths

Proprietary AI Platforms and Tools

Palantir has developed proprietary AI platforms that cater to organizations requiring advanced data analytics. Its flagship products, Palantir Foundry and Gotham, are designed to process and analyze massive datasets, enabling users to make informed decisions. Foundry focuses on commercial enterprises, offering tools for supply chain optimization, predictive maintenance, and operational efficiency. Gotham, on the other hand, serves government agencies, providing capabilities for intelligence gathering, defense operations, and counterterrorism efforts.

These platforms leverage cutting-edge machine learning algorithms to deliver actionable insights. Palantir’s emphasis on customization ensures that its tools integrate seamlessly with existing IT infrastructures, making them highly adaptable across industries. This adaptability has positioned Palantir as a leader in enterprise AI solutions, particularly in sectors where data security and precision are paramount.

Applications in Government and Enterprise Sectors

Palantir’s AI solutions have found significant applications in both government and enterprise sectors. In the public sector, its Gotham platform supports defense and intelligence agencies by analyzing complex datasets to identify threats and streamline operations. For example, the U.S. Department of Defense relies on Palantir’s tools for mission-critical tasks, including battlefield intelligence and logistics planning.

In the private sector, Foundry has gained traction among Fortune 500 companies. It helps businesses optimize operations, reduce costs, and improve decision-making processes. Industries such as healthcare, financial services, and manufacturing have adopted Palantir’s platforms to address challenges like patient data analysis, fraud detection, and supply chain management. These applications highlight Palantir’s versatility and its ability to drive value across diverse sectors.

Nvidia’s AI Strengths

Leadership in AI Hardware (GPUs, Chips)

Nvidia dominates the AI hardware market, with its GPUs serving as the backbone for AI workloads. The company’s market share in AI hardware has grown from 80% in 2020 to a projected 88% by 2025. Nvidia’s GPUs, such as the A100 and H100, are essential for training and deploying machine learning models due to their unmatched computational power. The A100, launched in 2020, revolutionized AI training, while the H100, introduced in 2022, optimized inference workloads, further solidifying Nvidia’s leadership.

Nvidia also offers DGX systems, purpose-built AI supercomputers adopted by major organizations for advanced AI research. Partnerships with cloud providers like AWS, Google Cloud, and Microsoft Azure have expanded Nvidia’s reach. For instance, AWS offers Nvidia-powered EC2 instances, making its GPUs accessible for AI tasks, while Google Cloud utilizes Nvidia’s A100 GPUs to enhance AI application development. These collaborations underscore Nvidia’s pivotal role in the AI ecosystem.

AI Software Frameworks and Developer Ecosystem

Nvidia complements its hardware offerings with robust AI software frameworks. CUDA, its proprietary parallel computing platform, enables developers to optimize AI applications on Nvidia GPUs. This software ecosystem includes tools like TensorRT for deep learning inference and cuDNN for accelerating neural network training. These frameworks simplify the development process, making Nvidia’s hardware more accessible to researchers and engineers.

The company has also cultivated a thriving developer community, providing resources, training, and support to foster innovation. Nvidia’s AI frameworks are widely adopted in industries such as healthcare, automotive, and finance, where they power applications ranging from medical imaging to autonomous vehicles. This combination of hardware and software capabilities has cemented Nvidia’s position as a leader in AI infrastructure.

Competitive Edge in AI

Differences in AI Innovation Between Palantir and Nvidia

Palantir and Nvidia excel in different aspects of AI innovation. Palantir focuses on software-driven solutions, offering platforms that enable organizations to analyze and interpret complex datasets. Its strength lies in its ability to provide tailored AI tools for specific industries, particularly in government and enterprise sectors.

Nvidia, on the other hand, leads in hardware innovation. Its GPUs and AI accelerators power the computational demands of modern AI applications. Nvidia’s dominance in the AI hardware market, with over 80% market share, reflects its unparalleled expertise in this domain. While Palantir excels in delivering actionable insights through its software, Nvidia provides the infrastructure that makes large-scale AI operations possible.

Synergies and Partnerships in the AI Space

Both companies leverage strategic partnerships to enhance their competitive edge. Palantir collaborates with government agencies and enterprises to develop customized AI solutions. These partnerships allow Palantir to address unique challenges, such as national security and supply chain optimization, strengthening its position in the AI software market.

Nvidia’s partnerships with cloud providers like AWS and Google Cloud have expanded its influence in the AI ecosystem. These collaborations make Nvidia’s GPUs and software frameworks accessible to a broader audience, driving adoption across industries. The synergy between Nvidia’s hardware and Palantir’s software also presents opportunities for collaboration, as organizations increasingly seek integrated AI solutions that combine powerful infrastructure with advanced analytics.

Financial Performance and Growth Potential

Palantir’s Financial Metrics

Revenue Growth and Profitability Trends

Palantir has demonstrated robust revenue growth and improving profitability metrics in recent quarters. Key highlights include:

- A year-on-year revenue growth of 39.3%, with total revenue reaching $883.9 million, surpassing Wall Street estimates by 2.5%.

- Guidance for a 38% year-on-year increase in sales for the next quarter, signaling continued momentum.

- Analysts project a 27.5% revenue growth over the next 12 months, marking an acceleration compared to the previous three years.

- A gross profit margin of 80.4%, slightly lower than the 81.7% recorded in the same quarter last year, reflecting potential competitive pressures.

- Operating profit margin improved to 19.9%, up 7.2 percentage points year-on-year, indicating better operational efficiency.

- Free cash flow reached $370.4 million, representing a 41.9% margin, significantly higher than the previous year.

These figures highlight Palantir’s ability to scale its operations while maintaining strong cash generation capabilities. However, the slight decline in gross profit margin suggests that the company faces increasing competition in the AI software market.

Stock Performance and Valuation Metrics

Palantir’s stock valuation reflects its high-growth potential but also underscores its premium pricing. The following table summarizes key metrics:

Palantir Technologies Stocks experienced a 74.57% increase in 2025, following a 340.48% surge in 2024. This performance reflects investor optimism about its AI-driven growth strategy. However, its high P/E ratio of 528.16 indicates that the stock is priced for significant future growth, making it a high-risk, high-reward investment.

Nvidia’s Financial Metrics

Revenue Growth and Profitability Trends

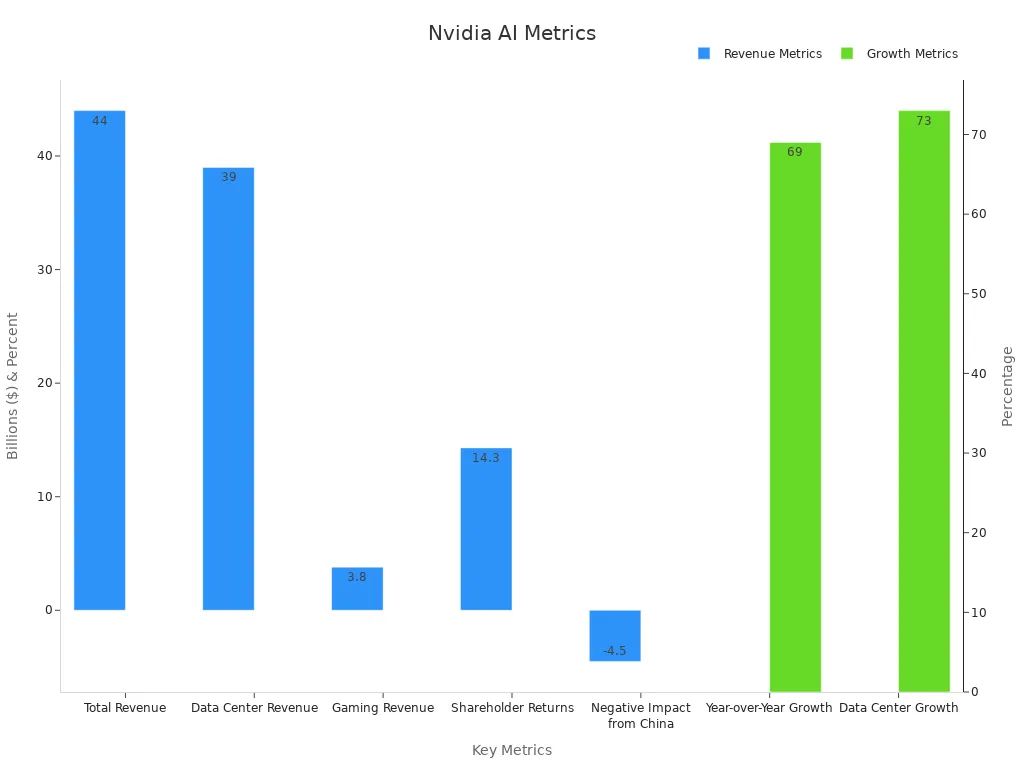

Nvidia has consistently delivered exceptional financial performance, driven by its dominance in AI hardware and data center markets. Recent statistics include:

- Revenue of $44.06 billion in Q1 FY26, a 69% year-over-year increase, supported by strong demand for GPUs in AI applications.

- Gross margin declined to 60.5% in Q1 FY26 from 78.4% in Q1 FY25, reflecting higher costs and pricing pressures.

- Operating income reached $21.64 billion, a 28% year-over-year increase, despite a 10% sequential decline.

- Net income grew by 26% year-over-year to $18.78 billion, showcasing Nvidia’s ability to generate substantial profits.

- Diluted earnings per share (EPS) rose by 27% year-over-year to $0.76, underscoring its strong earnings growth.

These metrics highlight Nvidia’s ability to capitalize on the growing demand for AI infrastructure, even as it navigates challenges such as export controls and rising costs.

Stock Performance and Valuation Metrics

Nvidia’s stock valuation reflects its leadership in the AI market and its strong financial health. The table below summarizes key metrics:

Nvidia’s forward adjusted P/E of 17.59 is significantly below the sector median, suggesting that the stock remains undervalued relative to its growth potential. The company returned a record $14.3 billion to shareholders in 2025, reflecting its strong financial position and confidence in future growth.

Growth Drivers for 2025

Key Factors Influencing Palantir’s Growth

Several factors are expected to drive Palantir’s growth in 2025:

- U.S. commercial sales increased by 64%, highlighting strong demand for its AI software solutions.

- Projected revenue of $3.75 billion for 2025, exceeding analyst expectations by 6%.

- Adjusted operating income forecast of $1.56 billion, 14% above market analysts’ predictions.

- The AI industry’s projected growth to $2.53 trillion by 2033 positions Palantir favorably within this expanding market.

Palantir’s focus on enterprise and government sectors, combined with its proprietary AI platforms, will likely enable it to capture a significant share of the growing AI market.

Key Factors Influencing Nvidia’s Growth

Nvidia’s growth in 2025 will be driven by several critical factors:

- Strong demand for GPUs in AI applications, particularly in data centers and autonomous vehicles.

- Strategic partnerships with leading tech companies, such as AWS and Google Cloud, to expand its market reach.

- Anticipation of new product announcements, including next-generation GPUs and AI platforms, at its annual shareholder meeting.

Nvidia’s ability to innovate and adapt to evolving market demands will ensure its continued leadership in the AI hardware market.

Risks and Challenges for Each Company

Risks for Palantir

Dependence on Government Contracts

Palantir faces significant risks due to its reliance on government contracts, which account for over 50% of its revenue. This heavy dependence creates a concentration risk, leaving the company vulnerable to changes in government budgets or policy priorities. Critics argue that this reliance limits diversification, exposing Palantir to potential disruptions if contracts are canceled or not renewed.

Additionally, the controversial nature of Palantir’s surveillance and AI technologies has drawn scrutiny. Regulatory changes or public backlash could jeopardize existing contracts. To mitigate these risks, Palantir has been shifting its focus toward the commercial sector, where U.S. commercial revenue grew by 64% in 2025. However, this transition remains a work in progress and does not fully offset the risks tied to government dependency.

Competition in the AI Software Space

The competitive landscape in the AI software market poses another challenge for Palantir. The company serves 125 corporate and government clients, with two-thirds of its revenue coming from its top 20 customers. This customer concentration increases financial vulnerability if key clients reduce spending or switch to competitors.

Palantir also competes with well-funded rivals in the data analytics and AI sectors. Companies like Snowflake and Microsoft have substantial resources and established customer bases, making it essential for Palantir to continuously innovate. Its premium valuation further amplifies the pressure to meet high investor expectations, leaving little room for underperformance.

Risks for Nvidia

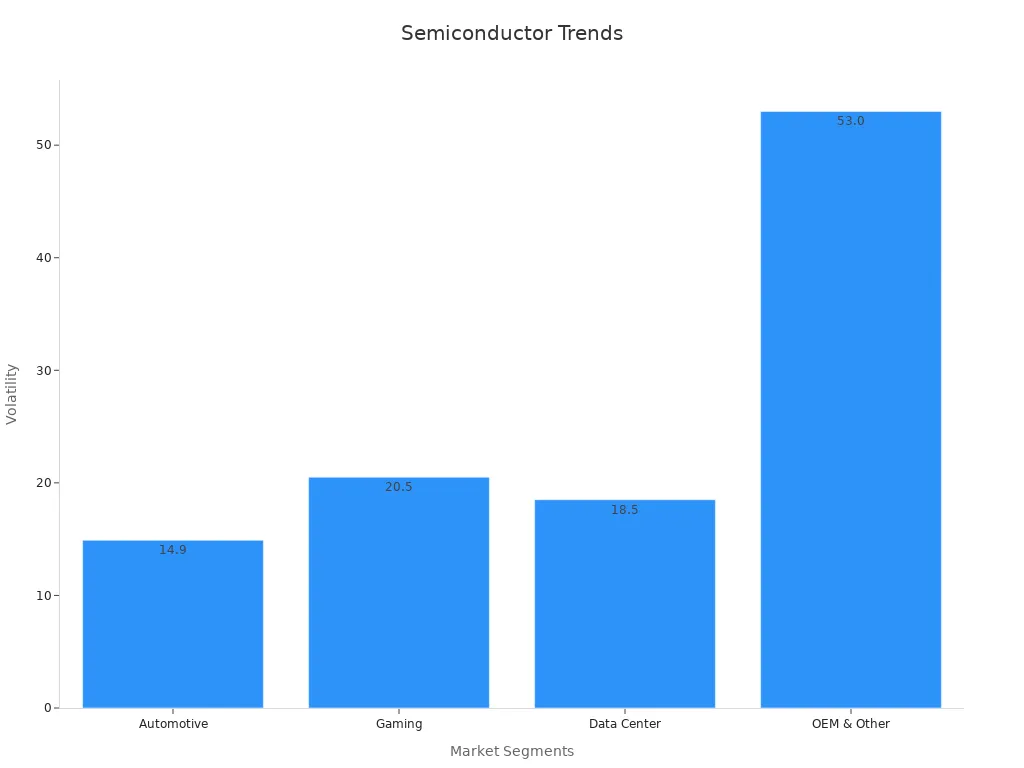

Dependence on Cyclical Semiconductor Market

Nvidia operates in the highly cyclical semiconductor market, where demand fluctuates based on product cycles and macroeconomic conditions. The gaming segment, for instance, exhibits high volatility, with sharp drops and recoveries tied to new product launches.

While Nvidia’s data center segment has shown explosive growth, other segments like gaming and OEM exhibit erratic performance. This cyclical nature makes Nvidia’s stock more susceptible to market downturns, particularly during periods of reduced consumer spending or geopolitical tensions.

Competition in AI Hardware and Software

Despite its dominance in AI hardware, Nvidia faces growing competition. The company holds a 95% market share in data center GPUs, but rivals like AMD and Intel are advancing rapidly. Chinese manufacturers are also making strides, potentially disrupting Nvidia’s supply chain and market share.

- Nvidia commands a 95% market share in data center GPUs, showcasing its dominance in the AI hardware market.

- Competitors like AMD and Intel are advancing in AI hardware, indicating rising competitive pressures.

- The AI Alliance is working on open-source technologies that could challenge Nvidia's proprietary systems.

- Chinese manufacturers are making advancements, suggesting a shift in the global supply chain that could intensify competition.

These developments highlight the need for Nvidia to maintain its technological edge while navigating an increasingly crowded market.

External Challenges

Regulatory Risks for AI Companies

Both Palantir and Nvidia face regulatory risks as governments worldwide implement stricter rules for AI technologies. Concerns over data privacy, surveillance, and ethical AI usage could lead to increased scrutiny. For Palantir, this could impact its government contracts, while Nvidia may face export restrictions, particularly in sensitive markets like China.

Macroeconomic Factors Impacting Stock Performance

Macroeconomic factors, including inflation, interest rate hikes, and geopolitical tensions, pose risks to both companies. Rising costs could squeeze profit margins, while global instability may disrupt supply chains. These external challenges underscore the importance of adaptability and resilience in navigating an uncertain economic landscape.

Nvidia presents a safer and more diversified investment option due to its dominance in the GPU market and robust AI infrastructure. Its revenue growth rate of 122% in Q2 and projected 106% annual growth highlight its strong financial trajectory. In contrast, Palantir appeals to risk-tolerant investors with its innovative AI platforms, despite slower growth at 27% and a higher valuation. Nvidia’s lower forward P/E ratio further underscores its favorable valuation. Investors must weigh their risk tolerance and confidence in each company’s strategy to determine the best fit for their portfolio.

FAQ

1. What makes Nvidia a safer investment compared to Palantir?

Nvidia’s dominance in the GPU market and its diversified portfolio of AI hardware and software make it a stable choice. Its consistent revenue growth and lower valuation metrics, such as a forward P/E ratio of 17.59, appeal to risk-averse investors.

2. Why is Palantir considered a high-risk, high-reward investment?

Palantir’s reliance on government contracts and its premium valuation increase its risk. However, its innovative AI platforms and rapid growth in the commercial sector offer significant upside potential for investors willing to take on higher risk.

3. How do Palantir and Nvidia differ in their AI focus?

Palantir specializes in AI-driven data analytics platforms for government and enterprise sectors. Nvidia leads in AI hardware, such as GPUs, and provides software frameworks for developers. Their strengths complement different aspects of the AI ecosystem.

4. Which industries benefit most from Palantir’s AI solutions?

Government, healthcare, and financial services are key beneficiaries of Palantir’s AI platforms. Gotham supports defense and intelligence operations, while Foundry helps enterprises optimize supply chains, detect fraud, and analyze patient data.

5. How does Nvidia maintain its leadership in AI hardware?

Nvidia invests heavily in research and development to innovate GPUs like the A100 and H100. Strategic partnerships with cloud providers, such as AWS and Google Cloud, expand its reach and ensure its hardware remains integral to AI infrastructure.

6. What are the main risks for Nvidia in 2025?

Nvidia faces risks from the cyclical semiconductor market and increasing competition from AMD, Intel, and Chinese manufacturers. Export restrictions and geopolitical tensions also pose challenges to its global operations.

7. How do macroeconomic factors impact both companies?

Inflation, interest rate hikes, and geopolitical instability can affect both companies. Rising costs may squeeze profit margins, while global supply chain disruptions could hinder operations. Investors should monitor these external factors closely.

8. Can Palantir and Nvidia collaborate in the AI space?

Yes, their strengths are complementary. Nvidia’s hardware powers AI workloads, while Palantir’s software analyzes complex datasets. Collaboration could create integrated solutions for industries seeking both robust infrastructure and advanced analytics.

0 Comments